NEWSLETTER – MARCH 2024

Marking the official public launch of our mapping study, the Consortium held a webinar, “Opportunities for Purpose-Driven Tech Innovation for the SDGs” on 14 February 2024. The event drew close to 500 registrants, with the number of attendees averaging about 160, representing 43 countries.

The webinar kicked off with a presentation of the research findings of our SDG-driven Tech Innovation Ecosystems mapping study, introducing the building blocks frameworks. The presentation underlined two key findings – the leading role that industry, VC, and social innovation pillars are playing in nurturing tech innovation aligned to the SDGs and the need for cross-sector collaboration and prioritisation to scale the SDG-aligned tech innovation ecosystem. High-level coordination is desperately lacking. To illustrate these points, the Consortium invited three distinguished guest speakers from the industry, VC, and social innovation sectors respectively, to provide remarks and share their perspectives.

Figure 1 – Speaker card for the webinar, “Opportunities for Purpose-Driven Tech Innovation for the SDGs.”

Jonathan Menuhin CEO of the Israel Innovation Institute delivered a compelling speech addressing the pressing question: What are the pathways for the industry to better harness tech and innovation to tackle the SDGs? Jonathan underscored the market’s failure resulting from a lack of awareness within industries regarding the SDGs, emphasizing the pivotal role of market education and community engagement in addressing this obstacle. He introduced the challenge-centric approach adopted by the Israel Innovation Institute, which empowers entrepreneurs to engage directly with corporations in solving SDG-related challenges.

Figure 2 – The Israel Innovation Institute’s international innovation ecosystems based on a challenge-centric approach

Hoi Ying So, Co-Head and Global Portfolio Manager at IFC’s Disruptive Technologies and Venture Capital provided valuable insights addressing the question: How can startups and VCs help meet the social and environmental challenges facing emerging markets? Hoi Ying stressed that for regions such as the Middle East or certain parts of Africa that have historically faced underfunding compared to other regions, the IFC intentionally focuses its efforts on both investing companies directly and supporting venture capital funds and fund managers to support their ability to raise money not only from Development Finance Institutions (DFIs) but also from local institutional investors as well. IFC also screens funds and investments to assess their alignment with the SDGs. In this way, IFC supports the development of venture markets, and SDG-aligned ecosystems more specifically, in emerging markets.

Laura Orestano, CEO of SocialFare in Italy provided a speech about how digital social innovation can be scaled domestically to meet the SDGs. She highlighted that while technology is widely accessible, its utilisation often fails to address key areas of well-being including environmental sustainability, equal opportunities, health, education, material living standards, and job security. Laura emphasised that social innovation goes beyond merely addressing societal challenges; it encompasses fundamental choices regarding how knowledge, policies, and sustainability are made accessible or shape the behaviour of users. This entails embedding and prioritising the right choices from the outset when developing and designing social innovation.

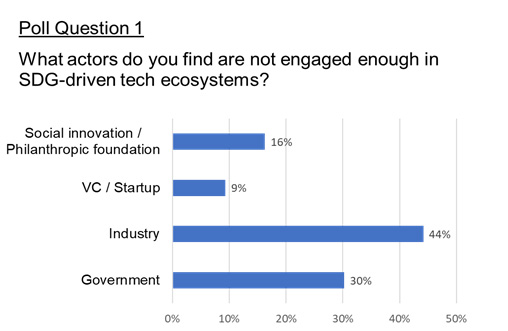

The event included a discussion providing participants with an opportunity to share their experience, thoughts, and perspectives. In response to the first question “Which actors do you find are not sufficiently engaged in SDG-driven tech ecosystems?” 44% of respondents identified industry, followed by government (30%), social innovation actors (16%), and venture capital (9%). During the discussion, one attendee emphasised the role of government, highlighting the exemplary practice of the Indian government in establishing digital public infrastructure to address the financial inclusion challenges faced by street vendors. Solutions such as these help to create an enabling environment for the development of SDG-enabled tech innovation ecosystems.

Figure 3 – Poll result of the question “What actors do you find are not engaged enough in SDG-driven tech ecosystems?”

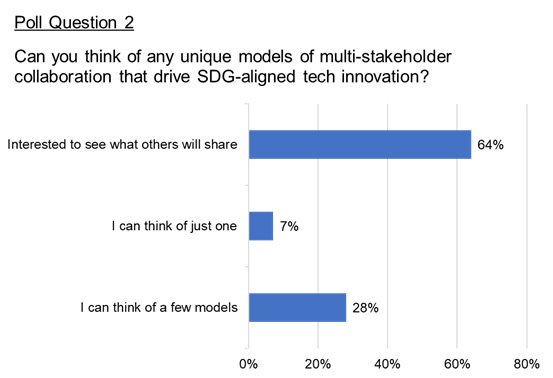

The second question posed was, “Can you think of any unique models of multi-stakeholder collaboration that drive SDG-aligned tech innovation?” Most participants were interested in hearing and learning about what others can share, while 28% indicated they could come up with several collaboration models for SDG-oriented tech innovation. A participant highlighted the effectiveness of government or foundation-led programmes that facilitate partnerships between technology experts and advocates for social change expediting the integration of diverse ecosystems to achieve the SDGs.

Figure 4 – Poll result of the question “Can you think of any unique models of multi-stakeholder collaboration that drive SDG-aligned tech innovation?”

As we reflect on the remarks and discussions of the webinar, it is evident that collaboration and concerted efforts from various stakeholders are essential for realising the full potential of tech innovation in addressing societal challenges. Looking ahead, the Consortium will remain committed to fostering innovation, collaboration, and knowledge-sharing to accelerate progress towards the SDGs.

You can revisit the webinar by watching the webinar recording and checking the presentation slides of the panellists.

IFIE (Israel NAB)

The Israeli Forum For Impact Economy (IFIE) is proud to share Israel’s first impact investing market sizing study, in collaboration with the tech and venture data and insights company, IVC Data and Insights, and Herzog Fox & Neeman law firm. The report estimates the total impact assets in Israel, alongside the initial assessment of the scope of impact-aligned technological investments. Some of the key findings include the following:

- While there’s a growing Israeli community addressing the SDGs, formal awareness of the SDGs as an investment framework is lacking across sectors.

- Merely 12 out of 23 surveyed impact investors and intermediaries categorize investments according to SDGs. Among those utilizing SDGs, primary objectives include SDGs 3, 9, 8, and 10

- Impact-aligned investments represent 23% of the total capital raised by Israeli tech companies (USD 20 billion out of USD 87.8 billion) between 2017 and the first half of 2023. Sectors such as Life Sciences and Cleantech lead, with 95% and 80% of companies classified as impact-oriented, while numerous other tech sectors also contribute, demonstrating the varied intersections of technology with societal and environmental values.

The broader Israeli SDG-driven tech innovation ecosystem has hosted and will continue to hold lots of exciting events and new programmes for entrepreneurs. For instance, Climate first, an Israeli climate accelerator, has announced the initiation of Cohort III, extending its reach into Europe. It will bring together 10 outstanding Seed and A-stage European Climate Tech companies from diverse verticals and industries.

Similarly, Impact.51, a startup studio dedicated to women’s health innovation, recently hosted its inaugural demo day focusing on projects for menopausal women. Concurrently, ‘Mission Resilience’ persists in entrepreneurial efforts, concentrating on solutions for trauma, PTSD, and anxiety.

On May 21-23, the Biomed Israel 2024 Exhibition, a leading life sciences conference in Israel, will feature the Start-Up Pavilion hosted by the Israel Innovation Authority. The Pavilion will offer a powerful, high-end platform for maximum exposure and business development opportunities, for innovative biotech start-up companies.

Furthermore, amidst the ongoing tensions and instability in Israel, various stakeholders including startup founders, management, and team members, are coming together to support the startup ecosystem. Notably, Iron Nation, an emergency impact fund for Israeli startups, has partnered with prominent high-tech executives, companies, and organisations to help sustain the growth of the most promising Israeli startups throughout and beyond the conflict.

MAZE (Portugal NAB)

In December, maze published a blog – Lessons from the SDG-Driven Tech Innovation Ecosystem – focused on the work done by consortium partners, particularly the Report’s main findings.

The Portuguese Social Security Institute created a new program, Projectos Inovadores (Innovative Projects), to support innovative social solutions in active ageing and elderly independent living. This initiative can foster digital social innovation among organizations from the social sector. It builds on the work of Portugal Social Innovation. The first call for applications is now closed, but it is expected others will open in the upcoming years, focusing on other social issues.

Casa do Impacto – a key player in the Portuguese impact ecosystem – has opened a call for its SDG-focused acceleration program Triggers that encourages new ideas and their transformation into sustainable solutions for solving environmental problems. Triggers support teams that show motivation and know-how for impactful entrepreneurship focused on environmental sustainability. Applications are open until February 11.

On January 25th, Portuguese companies and the public sector participated in the 3rd edition of the Conferência de Negócios Sustentáveis 20 – 30 (Sustainable Businesses Conference 2020-2030), organized by Jornal de Negócios. This year, the conference focused on technology, particularly Artificial Intelligence, to explore the challenges of environmentally sustainable governance.

In addition to the upcoming webinar, our team will continue collaborating with the project partners to disseminate the work done, thereby promoting the development of SDG-aligned Tech Ecosystems in Europe.

FAIR (France NAB)

Following the launch of the SDG-Driven Tech Innovation Ecosystems synthesis report across 7 countries at the GSG Global Impact Summit in Malaga, FAIR published its French ecosystem report in December 2023. The report provides the three following key recommendations to enable the tech innovation ecosystem to align with the SDGs:

- Develop pre-seed and seed funds for companies aligned with the SDGs

- Create an incentivizing regulatory framework

- Promoting a common non-financial evaluation model

Among the key players in the French ecosystem, France Digitale published a practical guide to enable businesses – startups, SMEs and large groups – to quickly understand the issues at stake in the European AI Act and anticipate the next steps in bringing their AI systems into compliance. Furthermore, they released their visionary manifesto for the 2024 European elections, outlining a robust plan for a competitive, innovative, and sustainable Europe.

Moreover, in February, Mouvement Impact France, along with other leading impact experts such as La French Tech, launched the Impact Lab to create impact unicorns, which aims to support around a hundred public and private players in business creation and development each year, thereby helping to raise the skills of the entire economic world and to bring about urgent prioritisation of these issues.

The ecosystem looks forward to ChangeNOW 2024, a 3-day event held between 25-27 March, bringing together the world’s innovative minds and sustainability leaders invested in the deployment of solutions for the planet. Several relevant events are envisioned at ChangeNOW such as FDTour, a tour of Paris’ impact tech ecosystem, hosted by France Digitale.

Social Impact Agenda per l’Italia (SIA) (Italy NAB)

As the Agenda2030 deadline is coming closer, the Italian innovation ecosystem is teeming with a variety of partners to take part in a set of initiatives aimed at tackling the challenges ahead while fully leveraging opportunities presented in the National Recovery and Resilience Plan.

Italy’s SDG-Driven Innovation Ecosystem embarked on a dynamic journey. In January, the Italian G7 Presidency kicked off with a strong emphasis on the geopolitical relations within the Mediterranean area and the African continent. Sustainable development ranks high on the G7 political agenda alongside the imperative for a new model of collaboration with the Global South. SIA, in collaboration with the GSG, is actively advocating for impact investing to feature prominently on the G7 agenda, building upon insights from the Impact Taskforce (ITF) State of Play 2023. Stay tuned for updates in the coming months!

Furthermore, the Finance for Impact: 2023 Italian Outlook. The Journey to Radicality report was unveiled early in the year, developed by TIRESIA Polimi in collaboration with SIA and supported by Impact Europe. The Outlook reveals that Italy’s impact finance has been growing from almost €7 billion in 2021 to €9.279 billion in 2022. Notably, it identifies the following Sustainable Development Goals as attracting the most investment from Italian impact investors: SDG 3 – Health and well-being, SDG 9 – Decent work and economic growth, SDG 10 – Reduction of inequalities, SDG 11 – Sustainable cities and communities, and SDG 12 – Responsible consumption.

Figure 5 – The United Nations 17 Sustainable Development Goals

On February 13th, a webinar, The Monetization of Impacts: The Role of IFVI and the ‘Impact-Weighted Accounts’ Approach by HBS was organized by SIA and Organismo Italiano di Business Reporting (O.I.B.R.), in collaboration with the GSG, International Foundation for Valuing Impacts (IFVI), the Impact-Weighted Accounts Project of the Harvard Business School where Sir Ronald Cohen, President of the GSG, was presented as a speaker.

The highly anticipated Consortium webinar “Opportunities for purpose-driven innovation for the SDGs,” featured a voice from SocialFare, the Italian Centre for Social Innovation, presenting a model of interest for European start-up incubators, accelerators, and impact investors.

“Renewable Energy Communities (CER) and Impact Investing” marked the launch of a new research and advocacy initiative by SIA aimed at exploring how community-led models could facilitate the green and just transition in Italian territories, with a particular focus on impact finance instruments. The inaugural “Impact-driven CER” webinar is slated for February 20th.

Last, but not least, on the 4th of March, Rome hosted “IMPACT NOW. Another Capitalism is Possible” organized by Human Foundation in collaboration with SIA and the GSG. The Conference gathered the European impact revolution leaders together with major actors from the impact investing ecosystem, under a shared vision: the urgent need to advance the impact economy and to bring values and goals of environmental sustainability, social solidarity, gender, and intergenerational justice at the core of financial activities.

Following the Conference, on the 5th of March, SIA hosted a meeting with GSG-affiliated European National Advisory Boards (NABs) to address impact investing-related challenges and opportunities at the EU level, aiming to present a unified voice and continue championing SDG-driven innovation tech ecosystems at the EU level.

Recent Comments